From the 10K

So obviously anything designated as ‘NPNS’ is not marked-to-market but on an accrual basis.

FX is on an accrual basis

From Note 5

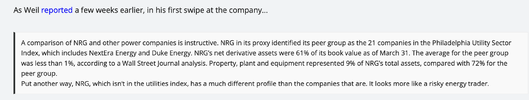

So this is ‘trading’, which was one of the criticisms of the WSJ article.

So let’s look at the breakdown:

So the margin cushion = +/- 12%

LOL.

So the reason provided for such a low margin is that ‘…may include policies that under certain circumstances, require losses…be shared…’

Those circumstances are not enumerated.

Then we have the ‘no market price’ risk.

This is probably the one that the WSJ most objected to

A whole raft of derivative contracts have been designate NPNS and they extend into 2036.

So no-one can accurately predict prices a week or two out, how about 11 years? LOL.

Customer relationships = derivative contracts.

Year-on-year

We have a loss.

Stock is up bigly.

More in due course.

jog on

duc